One of the most important issues for anyone planning a trip is insurance to India for visitors to the country. Now the procedure is much easier than it used to be. A full range of online insurance services is available on the company’s website. All the requirements of Indian legislation are taken into account. The customer can choose which risks he would like to take and which are not relevant for him.

The first and most important is to act in a timely manner, so that you have the document with you when you cross the border. That is, a tourist must have a policy for a successful departure. Before traveling abroad, think about what risks may be on the way or in place.

General nuances of insurance. What to consider

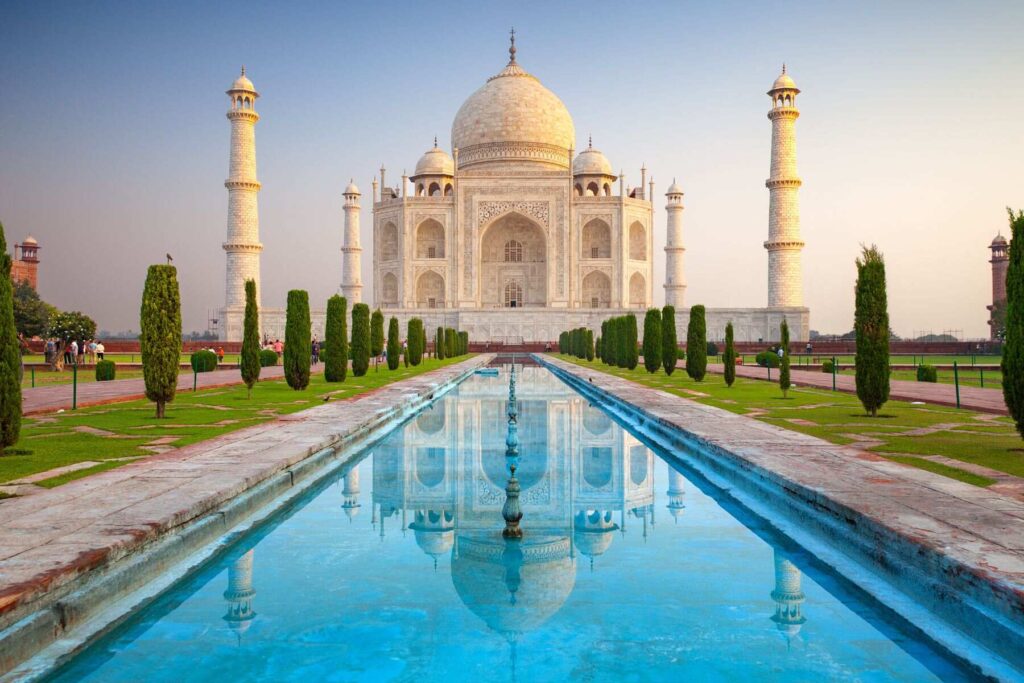

Let’s start with the basics. Whether you’re planning a vacation to Goa or flying to New Delhi to meet with business partners, the pattern is the same. The traveler needs health insurance in India, covering the most likely health risks. However, with Indian specifics. That is, taking into account the climate, new conditions, local food and sanitary conditions in the region you plan to visit. Also, local bacterial, viral, and parasitic infections are common in this country. Poisonous insect and snake bites are possible in some regions. If you are planning to visit them, your travel insurance for India should also take into account such probabilities.

If any extreme entertainment is on the list of plans, it is worth insuring additionally against accidents that may occur in the process. In particular, scuba diving is a popular option. Depending on such risks, travel insurance in India may even include search and rescue operations.

Let’s take a look at the rates for medical care in Indian clinics. Consider affordable options, as elite facilities are much more expensive.

| Service | Price, USD |

|---|---|

| Standard check-up examination in an inexpensive private clinic | 100-200 |

| Appeal to doctor, prescription | 20-50 |

| Tests | 10-20 |

| Root canal treatment | 180 |

| Restoration or inexpensive crown (1 tooth) | 200 |

What coverage points should be added

Not only do you need standard medical insurance to India covering medical treatment, hospitalization, etc., but also protection against other risks. Here are a few basic options:

- You had to cancel your tickets and lose some money (including non-cancellable reservations)

- A flight was canceled or rescheduled for reasons beyond your control – weather, disaster, accident, problems at the airport

- Baggage was lost by airport employees

- You rented a vehicle, equipment, and need to reimburse for its repair or damage to third parties.

All these points can include your insurance in India. At the same time, its price is calculated as accurately as possible. There are no imposed services or hidden fees in the policy. You can easily find reviews of our work.

FAQ

The cost depends on the selected product. The website shows the basic insurance in India, the price of extended packages. Additional coverage (sports, extreme) is calculated individually.

To buy a medical insurance policy, fill in a form on the website, provide documents and get a ready-made document.

You can call our hotline immediately. Operators take calls 24 hours a day. Record the insured event and consult with a company representative.